Our conversation.

Did Donald Trump do anything fun today?

Yes. They found $4.7 trillion in Treasury payments on an untraceable budget line and that there are more than 20 million Americans over the age of 100 listed as eligible for social security, some as old as 139.

How does this happen?

Incompetence?

Fraud?

I’d bet on both.

As of 2023 there are 438 federal agencies in the United States government. The U.S. federal government employs around three million people as of November 2024. This includes both civilian and military personnel.

Most of these individuals weren’t elected by you, but you pay them.

Remember government doesn’t produce anything, it just spends the money it takes from you and makes laws and rules you are to follow.

When a law is passed by Congress, it gets handed off to unelected employees of the federal government to implement. These employees craft the rules and regulations to implement the law.

The following illustrates how many rules and regulations get implemented per law passed.

One could conclude that these unelected rule-writers have more power than the elected.

I know that’s how I feel.

The rule-writers exist because laws that get passed by Congress are incomplete. Congress passes the broad statutes that govern us, but most of the details are left to federal agencies to figure out through the rule making process.

Thus, our elected officials don’t do the details because it might piss off constituents and they may not get re-elected.

The rule-makers do the details.

If you actually read a bill passed, there’s lots of “TBD” in the actual document, it’s the rule-makers who do the detail. In essence rule-writers are actually creating the laws.

These rule-writers are responsible for generating the Code of Federal Regulations (CFR).

What is the CFR?

The Code of Federal Regulations (CFR) presents the official and complete text of agency regulations in an organized fashion in a single publication. You can browse it here.

The CFR is updated by amendments appearing in the daily Federal Register.

Used together, these two publications establish the latest version of any given rule.

If you’re wondering what the difference is between a rule and a law, I know I was wondering, here is the best definition I found:

Laws are based on broad principles, while rules are based on narrow technicalities in their application to specific cases and people involved in different situations. Laws are created by legislatures who delegate authority to agencies (unelected bureaucrats) to make rules within their specific areas of expertise, and these rules also have the force of law.

These are the faces of people who are outraged at the idea of eliminating thousands of these rule-writers.

Just looking at these photos of them protesting the current cuts outrages me.

"There's this concept in private equity when you get a bankrupt company and you go in there, you cut 20 percent more than your initial read, and then you find, like a pool of mercury, the organization gels back together again. Always cut deeper, harder when there‘s fat and waste. The FAA, it‘s not the people. The code is COBOL [Common Business-Oriented Language]. It‘s from the '60s. It needs CapEx put into it for the technology. We upgrade it to make it safer. Fat like a chicken. All of these agencies are like big fat chickens dripping over barbecues of fat. This is the best barbecue I‘ve ever seen, but I don‘t think it‘s happening fast enough. They‘re not cutting enough. Keep slashing. Keep hacking while you have a 24-month mandate before the midterms. Cut, cut, cut, cut, cut, cute - more, more cutting. Believe me, it‘s going to work out just great. Everybody should be happy about it." Kevin O'Leary

I agree with the idea to cut, cut, cut.

But where’s the outrage from the people (you and me) paying the outraged opposers and the rule-writers?

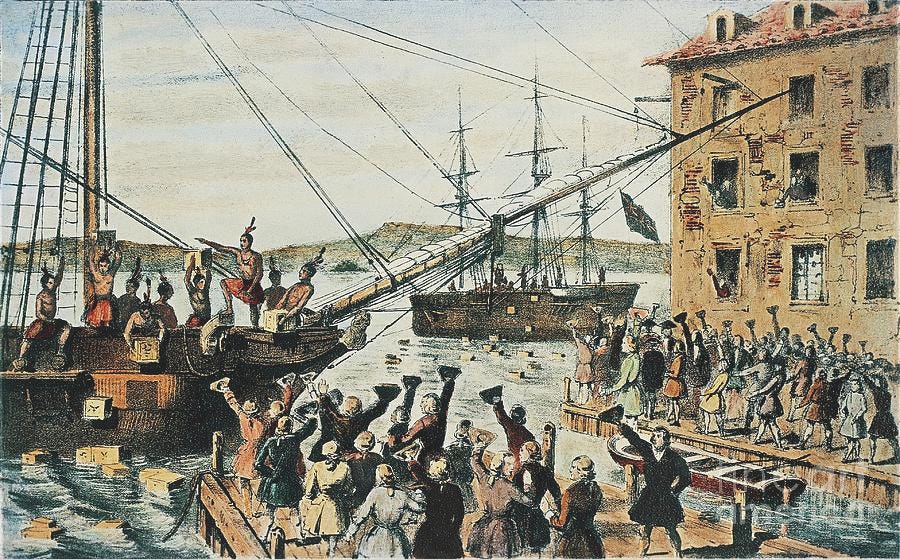

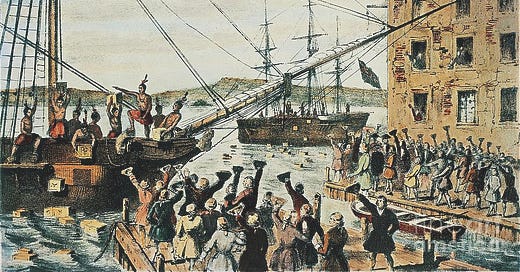

Remember the Boston Tea Party?

The Boston Tea Party was a political protest that occurred on December 16, 1773, at Griffin’s Wharf in Boston, Massachusetts. American colonists, frustrated and angry at Britain for imposing “taxation without representation,” dumped 342 chests of tea, imported by the British East India Company into the harbor. The event was the first major act of defiance to British rule over the colonists. It showed Great Britain that Americans would not tolerate taxation and tyranny sitting down, and rallied American patriots across the 13 colonies to fight for independence.

Once upon a time we had outrage.

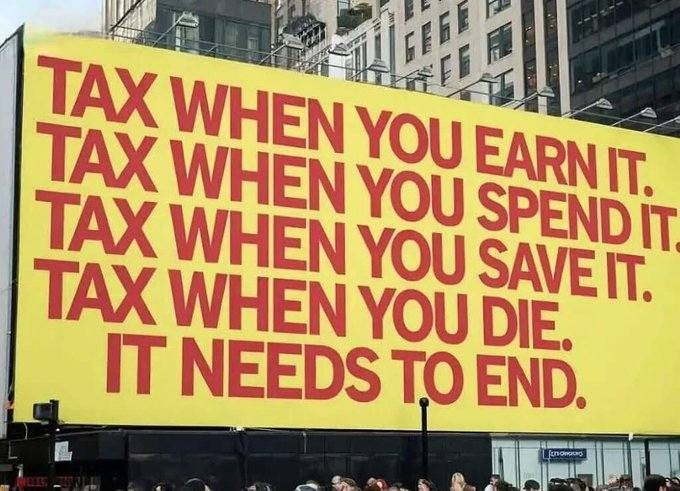

How many things have you gone without because a good deal of your paycheck went to State and Federal governments?

Because every step of every day, you’re taxed.

Have you ever thought about how many places you are taxed?

We are being taxed without representation in a modern sense.

Just like the American Colonists in 1773.

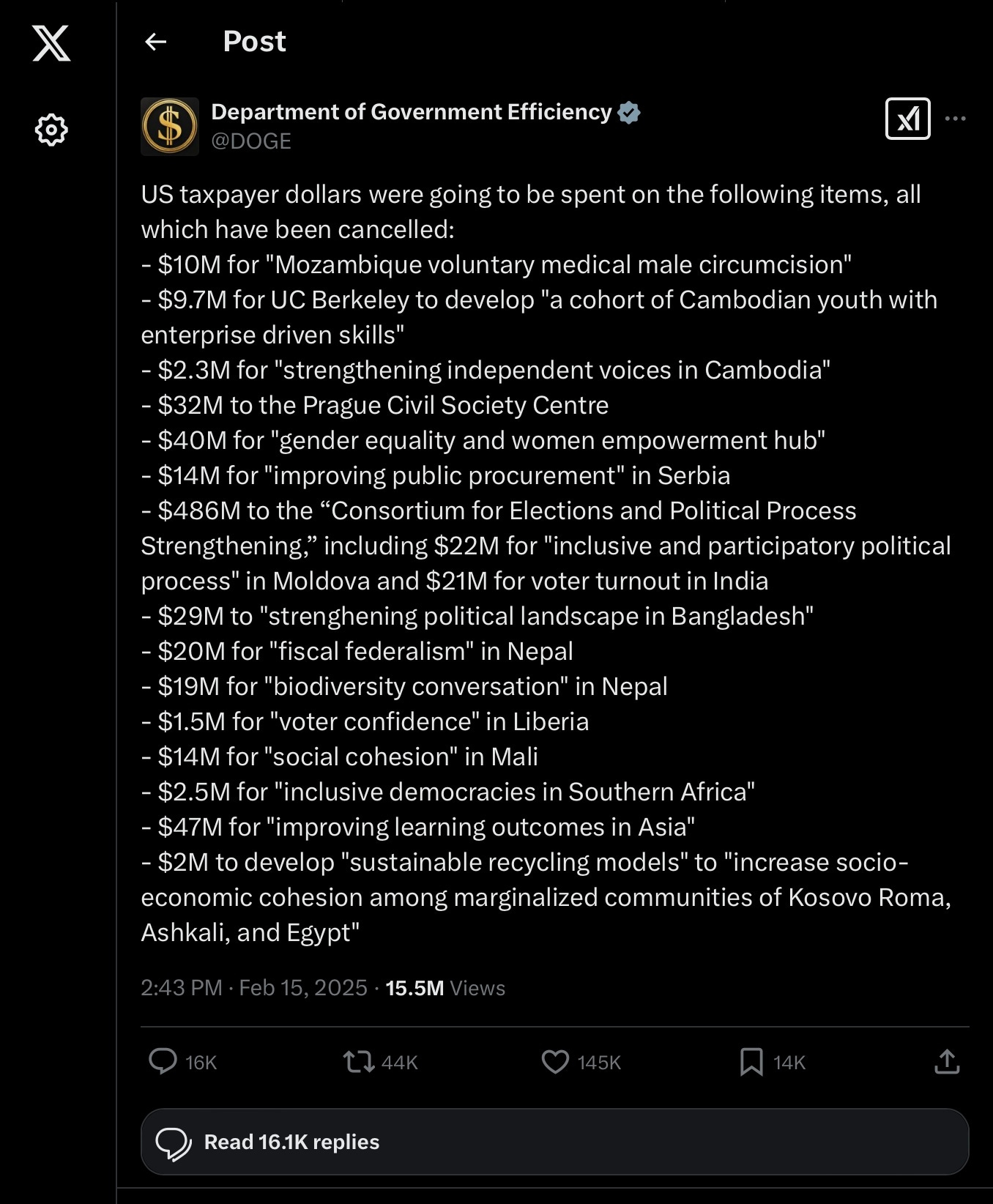

The government takes our money and often spends it to benefit entities external to the United States, sometimes to the detriment of American taxpayers.

The list I included above is just the tip of the iceberg.

So where does all this money come from?

YOU.

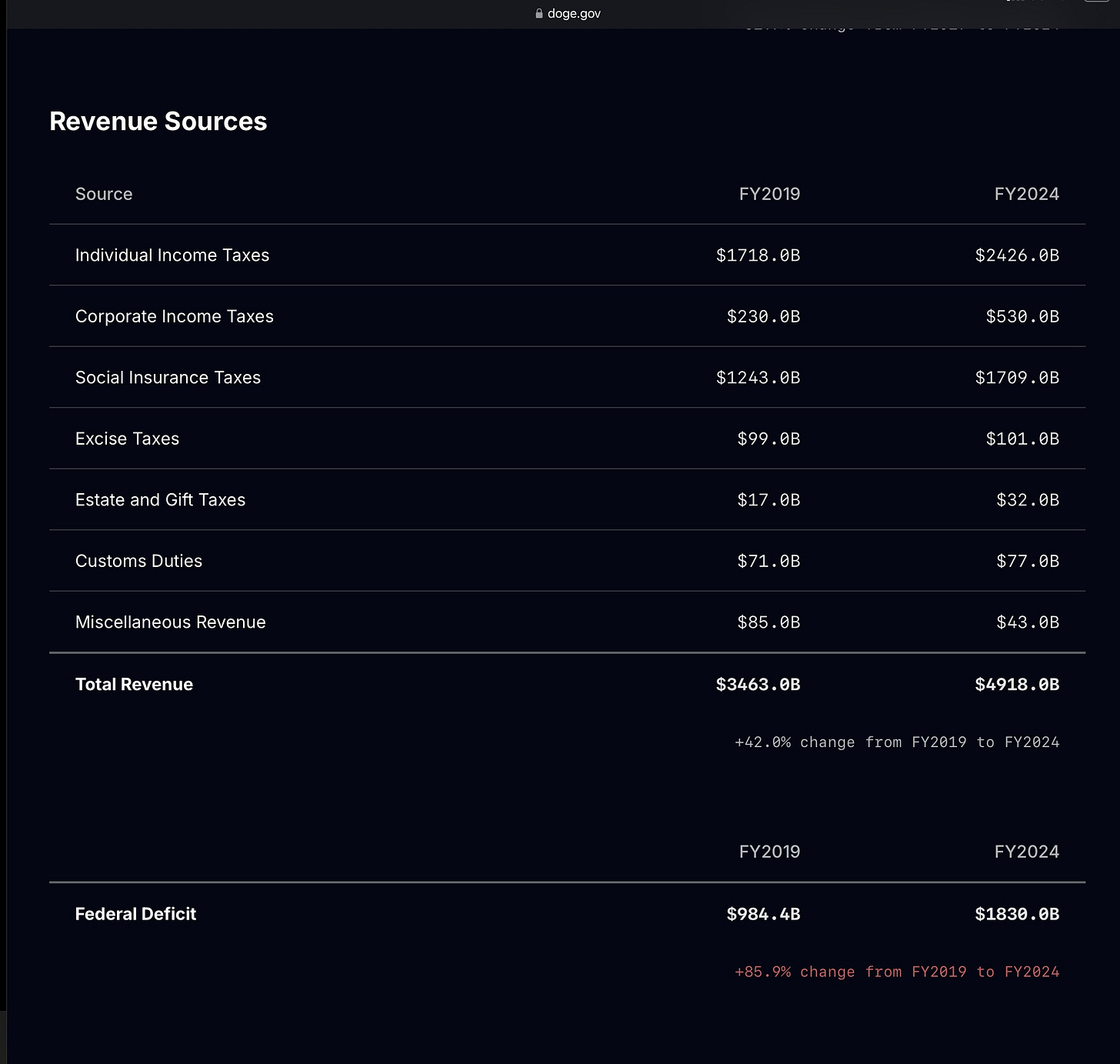

This chart illustrates where the government gets the money to spend.

The biggest line items are obvious, but almost all of these line items involve your wallet.

I’ll explain.

Individual Income Taxes

Individual income tax is also referred to as personal income tax. This type of income tax is levied on an individual’s wages, salaries, and other types of income.

In 1862, to finance the Civil War, President Abraham Lincoln(R) and the Republican Congress enacted the country’s first federal income tax. After the war, the tax was repealed, but it was reinstated after the passage of the Revenue Act of 1913.

The Revenue Act of 1913 reintroduced a federal income tax in the United States and significantly lowered average tariff rates from about 40% to approximately 27%.

Tariffs, sometimes called duties or customs duties, are taxes on goods that are traded between nations. When goods cross the US border, Customs and Border Protection (CBP) collects tariffs based on the type of goods. These rates can vary widely depending on the type of product and the country of origin. They are designed to make imported goods more expensive to protect domestic goods.

Prior to the 1930s, Congress set most tariffs by passing legislation. Since then, it has delegated much of that authority to the president through legislation, authorizing the White House to adjust rates.

As of October 2024, our average tariff rate was 3.4%, but it varies broadly based on the product, cost, quantity, and relationship between the importing and exporting countries

The Revenue Act of 1913 marked a shift in federal revenue policy, emphasizing income taxes over tariffs for government funding.

The act was sponsored by Representative Oscar Underwood(D) passed by the 63rd United States Congress, and signed into law by President Woodrow Wilson(D). At the time, Democrats had an overall federal government trifecta controlling the House, the Senate and the Presidency.

Woodrow Wilson and other members of the Democratic Party had long seen high tariffs as equivalent to unfair taxes on consumers, and tariff reduction was President Wilson's first priority upon taking office. Democratic leaders agreed to seek passage of a major bill that would dramatically lower tariffs and implement an income tax.

The Revenue Act of 1913 also illustrates that as far back as 1913 Democrats didn’t and still don’t understand how business works. Both Woodrow Wilson and Oscar Underwood were lawyers first and politicians second. Neither had ever run a business or were responsible for making payroll.

One system takes from you (income tax system) the other (tariff system) allows you to choose if you want to pay for that imported item.

Tariffs also encourage domestic production.

Because of new tariffs on products that come in from Mexico, it is rumored that Apple CEO Tim Cook promised that the company’s manufacturing would shift from Mexico to the US during a meeting at the White House recently.

It makes more sense to me to make international companies, through imposed tariffs, pay for our Government than average Americans, especially if America is going to continue to be the piggy bank for the world.

Corporate Income Taxes

Businesses also pay income taxes on their earnings. The Internal Revenue Service (IRS) taxes income from corporations, partnerships, self-employed contractors, and small businesses.

Depending on the business structure, the corporation, its owners, or shareholders report their business income and then deduct their operating and capital expenses. Generally, the difference between their business income and their operating and capital expenses is considered their taxable business income.

All businesses typically incorporate this tax into the price of the product, passing the cost onto the consumer.

The call to make rich corporations pay “their fare share” simply means you’ll pay more for whatever they’re selling.

Social Insurance Taxes

Social insurance taxes are taxes collected to fund social insurance programs, such as Social Security and Medicare in the United States. These taxes are typically deducted directly from employees' paychecks and are used to provide benefits for retirement, disability, and healthcare for eligible individuals.

The funds collected for Social Security are not put into a trust for the individual employee currently paying into the fund, but are rather used to pay existing older people in a "pay-as-you-go" system.

We paid for our parents. Our kids are paying for us.

As of 2024, the Social Security tax rate is 12.4% of your earnings up to a maximum wage base limit of $168,600. Half of the tax, or 6.2%, is paid by the employer, and the other 6.2% is paid by the employee. For self-employed individuals, the full 12.4% is paid on their net earnings, up to a maximum wage base limit of $168,600.

The Social Security tax rate is assessed on all types of income earned by an employee, including bonuses.

If you are retired and you earn between $25,000 and $34,000 and file as an individual, you may have to pay up to 50% in taxes on your Social Security benefits.

If you earn more than $34,000, you may have to pay up to 85% on your Social Security benefits.

If you withdraw money from your 401(k) before age 59½, you typically face a 10% early withdrawal penalty in addition to regular income taxes on the amount withdrawn.

Social Security is always taxable, regardless of age.

Your income in any given year determines whether or not your Social Security benefits are taxed.

Did you vote for any of this?

Does any of this make sense to you?

The beast needs to be fed though.

Excise Taxes

An excise tax is a specific type of tax that is levied on certain goods or services at the time of their purchase.

In the United States, common goods subject to excise taxes include motor fuel, tobacco, and airline tickets. These taxes are usually imposed at the federal level but can also be applied by state and local governments.

Excise taxes are primarily intended for businesses. They typically incorporate this tax into the price of the product, passing the cost onto the consumer.

They are separate from other taxes that corporations must pay.

In some cases, governments levy excise taxes on goods that have a high social cost, such as cigarettes and alcohol. These types of excise taxes are sometimes called sin taxes because the good being taxed has a reputation for being "sinful" or with negative consequences associated with it.

Sin taxes on targeted goods like beer and alcohol will often be taxed at the federal level and also taxed again by the state, making the cost of these items higher. The proprietor just passes the tax onto you.

Excise taxes are also charged on some retirement account activities. Many people are familiar with these taxes as penalties.

A 6% excise tax is applied to excess individual retirement account (IRA) contributions that are not corrected by the applicable deadline.

A 10% excise tax penalty applies to distributions from certain IRAs and other qualified plans when an investor makes withdrawals before age 59½.

Also, a 25% excise tax penalty is charged when investors do not take the mandatory required minimum distributions (RMDs) from certain retirement accounts, though this tax is reduced to 10% if the missed distribution is taken before the end of the "correction window."

Excise and sales taxes are two different types of taxes.

An excise tax is imposed on specific goods and is generally the responsibility of the merchant to pay to the government. The merchant, in turn, may or may not pass the tax on to the consumer by adding it to the price.

On the other hand, a sales tax is charged on almost everything and is collected from the consumer by the merchant who passes it on to the government. The sales tax is a percentage of the price of a good or service.

Estate and Gift Taxes

The estate tax is a federal tax levy on the estate of a person who dies, based on the current value of its assets. An estate tax applies when the value exceeds an exclusion limit set by law. Only the amount that exceeds that minimum threshold is subject to tax.

For 2025, estates with combined gross assets and prior taxable gifts exceeding $13.99 million must file a federal estate tax return and pay estate tax, up from $13.61 million in 2024.

Assessed by the federal government and several state governments, these levies are calculated based on the estate’s fair market value (FMV) rather than what the deceased originally paid for its assets. The tax is levied by the federal government, and by the state where the deceased was living when they died, if that state has an estate tax.

The first estate tax in the United States was enacted in 1797, to fund the U.S. Navy. It was repealed but reinstated over the years, often to finance wars.

The modern estate tax as we know it was implemented in 1916.

From the I.R.S. (Internal Revenue Service) (they’re the government people you send your tax money to):

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The tax applies whether or not the donor intends the transfer to be a gift.

The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return. If you sell something at less than its full value or if you make an interest-free or reduced-interest loan, you may be making a gift. https://www.irs.gov/businesses/small-businesses-self-employed/gift-tax

Customs Duty

Import duty is a tax collected on imports and some exports by a country's customs authorities. A good's value will usually dictate the import duty. Depending on the context, import duty may also be known as a customs duty, tariff, import tax, or import tariff.

Import duties increase the cost of foreign goods in the domestic market, thereby making locally produced goods more competitive. Export duties directly affect the profitability of exporting goods by making them more expensive for foreign buyers. This can lead to a reduction in export volumes as exporters may find it less attractive to sell their goods abroad.

From a trade policy perspective, import duties are often used strategically to protect strategic industries that are deemed important for national development or security.

But regardless of an import or export, the end user will be paying the tax not the business.

The U.S. federal government is a starving beast that constantly needs feeding.

Cutting spending and personnel helps slim the beast down, sort of like how Ozempic slimmed down Oprah.

You’ll read about the outrage from those in our government who want the status quo (the existing state of affairs, especially regarding social or political issues) to remain.

But where’s the outrage from the people paying for our government?

Interested in what’s being cut?

It’s updated in real time most days.

An interesting read about USAID in Africa:

I am outraged.

I remember a story from long ago, regarding Africa. the US had sent Africa a bunch of sewing machines office equipment (projectors) and farm machinery. a year later, My father went over to check on the status of the delivery.

The guy thanked my dad for the delivery and showed the big room where all of the stuff was stored. They had no electricity and no gas. :-/ that was probably in the 1980s. I am not sure what the status is these days, but my dad was pretty shocked at the stupidity of the whole operation from start to finish. Well, Africa is pretty dry, I think the stuff is probably well preserved

Too bad the TEA Party from 2010ish fell apart.