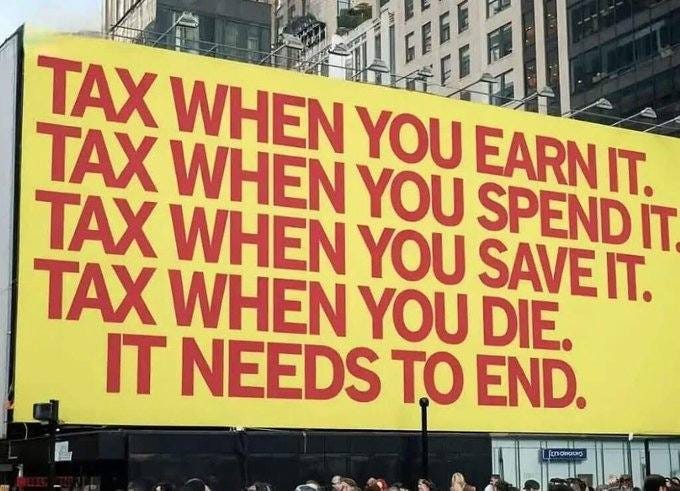

For me it is mind boggling how much money the government takes from us.

Once upon a time the government representatives you voted for treated tax money like it was their own and were very careful with spending. This isn’t true anymore and hasn’t been for a very long time, since about the mid to late 1980’s.

The U.S. Government has many social programs where the spending is very high. The cost of the Military is very high. We send unbelievable amounts of our tax money to other countries. There are hundreds of places to read about government waste with your money. You can’t really do anything about it except to vote for people you believe will be thrifty with the money you give them they take.

One of my pet peeves is real estate property tax.

Property tax is a huge cash cow for local governments and it is very difficult to get a property tax to go down.

Once upon a time there was a similar system that only ended because of warfare, disease and political change.

The feudal system was a social and economic structure that dominated medieval Europe from the 9th to the 15th centuries. Under Feudalism, a monarch's kingdom was divided and subdivided into agricultural estates called manors. The nobles who controlled these manors oversaw agricultural production and swore loyalty to the king.

Peasants and serfs worked the land and provided goods in return for rent and protection.

Peasants and serfs were both common social classes in medieval Europe, but they had distinct differences in their rights and obligations. Peasants were typically free individuals who owned or rented small plots of land and were able to move and work for themselves. Serfs were bound to the land they worked on and were considered the property of the lord. They were not allowed to leave the land without permission and were obligated to provide labor and pay taxes to the lord.

Same monkey, different tail.

Despite the social inequality it produced, Feudalism helped stabilize European society. But in the 14th century, Feudalism waned. The underlying reasons for this included warfare (The One Hundred Years’ war), disease (the Black Plague) and political change (which is where the Magna Carta came from).

And when feudalism finally came to an end, so did the Middle Ages.

Sound familiar?

You’re a peasant paying to live in the manor.

Let’s do some math. I owned a piece of rental real property (a house) that was valued at roughly $275,000. Property tax rates are high here, not as high as other places, but still high. I paid (rounded) $3700.00 twice a year, $7400 a year in property taxes. I had a thirty-year mortgage, so, say I stayed in my house for the thirty-years, I would pay $222,000 in property taxes. Now that is providing the tax rate stays the same (which it won’t, between 2017 and 2019 my taxes increased thirty one percent).

Now say I paid off that mortgage and continued to live there. Each year I would be paying $7400 to the county to live there. If you don’t pay it, they take your house because of “owed back taxes”. So if I stayed in my house for 50 years, sticking with the $7400 number I’d pay an additional $148,000 to the local government.

$370,000 paid to government to live in a house I supposedly own.

How would this sit with you if this were your picture?

Did you know that you paid taxes on the same piece of real estate year after year, never ending until you sell?

But they don’t want you to understand it either. Your property tax is complicated to calculate. The tax total for each year relies on imperfect property assessments and confusing metrics like mill levies, or “mills,” which represent one dollar of every $1,000 in assessed property value.

At what point does the real estate become a liability?

When you can no longer afford to live there.

Let’s play around with some more tax money.

Property taxes generally pay for the public schools. The public schools generally receive the largest portion of what you pay in total property tax. Now you’ll hear the argument that in a civilized society we all pay our fair share to provide for schools etc., but let’s visit “fair” for a moment.

Now let’s say that in an urban community where there are homeowners and renters, the rental population is sixty percent and home ownership is forty percent (which are the exact statistics we have where I am). The rent money a renter pays more than likely includes a portion of the property tax on the apartment building, so say you have twenty residents all chipping in on that one property tax, compared to one family paying the full amount. What do you think happens when the schools put an issue on the local ballot to raise property taxes so the schools can get more of your money?

I’ll tell you what.

The homeowners generally attempt vote the issue down, all the renters vote to increase the property taxes.

Fair share?

But there’s more.

In the urban center where my rental house is located, the school spends roughly $13,000 to $17,000 per student and is an “F” rated school system (schools are rated A-F with A being schools where grade school children can actually read when they leave the 8th grade).

As a homeowner, forced to pay $7400 per year, how would that make you feel?

How about a homeowner who never used the school system because they chose to homeschool or a tuition based school?

This example is just one example of how a local government spends the money it extracts from you. Think about what the Federal government does.

Currently, four states are considering eliminating property taxes. Florida, Illinois, Kansas and Pennsylvania are looking into eliminating property taxes. Each state has bills being introduced by republican representatives.

Will they pass?

Only if these governments find other ways to fund what otherwise would have been covered by property taxes,

“If you have to pay annual taxes to keep your home, then you don’t really own it.” “Is it private property or not?” Ron DeSantis, governor of Florida.

In 2019 the Federal Government took in $3.3 trillion in tax revenue. Eighty percent, or $2.7 trillion came from individuals.

Cook that in your brain a minute.

Your money is their lifeline.

Just remember, the government is counting on you not having the basics civics lessons to understand what they are doing with your money.

Educate yourself through reading.

The government doesn’t make money – ever.

It takes it from you and redistributes it how it sees fit.

You can control it to some degree at the ballot box.

Great article!! Property taxes are wrong on so many levels. Your take explains clearly why "Home Ownership" has been sold to us by the ruling class as the "American Dream" for generations ...... I have a friend with a million-dollar home in Illinois paying 28k in taxes (and 7k in HOA). That is 3k a month to live in the home he owns outright. If he had put his million in short-term treasuries at 5%, he would have 4k a month in cash flow, instead of a 3k per month outflow. So, in effect, he is paying 7k per month to live in that home. He asks why I live in a humble 3bd/2ba when I could afford much better. The answer is 2k per year in taxes, with no HOA. Seems like a no-brainer.....

The only certainties are death and taxes. Ben Franklin, I believe.